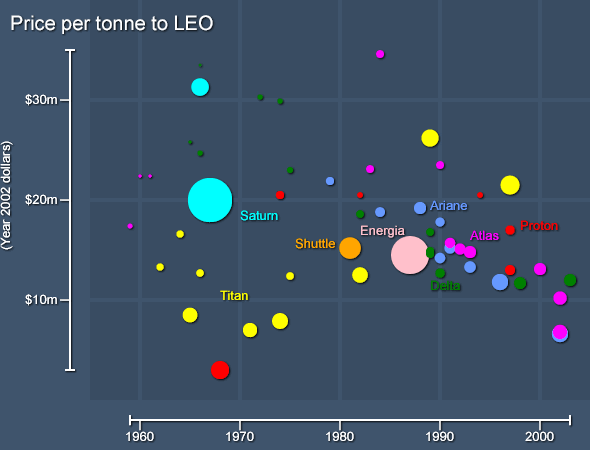

The cost of "interface" transportation between the surface of the Earth and low orbit is the determining factor in the feasibility of many schemes for space industrialisation. If access to space is sufficiently cheap, then not just mining operations (as described in part one of this series), but solar power satellites, scientific outposts on the Moon, voyages to Mars and even cities in orbit would become affordable. Unfortunately, very little progress has been made in the development of cheap launchers. In 1996, it cost $11.8m (2002 dollars) to put a tonne of payload into low Earth orbit using an Ariane 5 rocket. In 1962, it would have cost $13.3m (2002 dollars) to launch a similar payload with a Titan 2 rocket. Decades of technology and billions of dollars of development costs separate the rockets we use in the twenty-first century from the workhorses of the early years of the Space Age, and launch vehicles are no more cost effective than they were.

Some features of the history of launch vehicles are readily apparent:

- The price of launches has only rarely fallen below $10 million per tonne (the low stated price of the Proton 8K82K is most likely an artefact of the Soviet system rather accurately reflecting the high value offered by that vehicle).

- There are relatively few heavy lift vehicles (the now obsolete Saturn V and Energia, the Shuttle, the various Titan variants), and a large number of launcher types adapted to more moderate payloads (in the region of ten to twenty tonnes).

- Since the early 1980s, there has been a steady fall in the price of launches towards prices reminiscent of the Titan boosters used for moderately massive payloads in the 1960s and early 1970s.

To understand these aspects of the graph, we need to understand three things:

- The inelasticity of the space access market.

- The evolution of the launch vehicle families.

- The engineering difficulties associated with reusable launch vehicles.

The elasticity of demand in the launch vehicle market is a measure of how much the number of launches demanded by customers changes when the price changes. If the market were elastic then the proportional change in the number of launches would be greater than the proportional change in the price of a launch. In that case, cutting the price of launches would be good for a launcher company, because they would then have a greater cashflow from the substantially larger number of launches. For example, if halving the price tripled the number of launches, the company would achieve a 50% larger revenue. Unfortunately, the current market is highly inelastic - the number of launches is only weakly dependent on the price.

The majority of customers for launch services are companies who want to launch telecommunications or remote sensing satellites. These are relatively small payloads, hence the lack of heavy lift boosters. (The Ariane 5 might appear to be an exception, but it was designed to orbit the European Hermes mini-shuttle and is now used to launch pairs of satellites.) The size of the market for launch vehicles is thus determined by the size of the market for telecommunications and remote sensing services rather than by factors internal to the launch market itself. The telecommunications market is certainly growing, but it's turned out to be more economically effective to increase the number of transponders per satellite rather than increasing the number of satellites. For example, consider the Astra series owned and operated by the Société Européenne des Satellites. The first in the series, Astra 1A, was launched in 1988 and carried 16 Ku-band transponders and six spares. The most recent, Astra 1K, was involved in a launch failure in 2002, but would have carried 52 Ku-band and two Ka-band transponders (enough to support 1,100 television channels). The number of satellites required by a given operator depends more strongly on the range of coverage required than it does on the price of each launch. It is likely that the continued growth in the telecommunications market will not increase the number of commercial launches even with a two-fold drop in the price of each launch.

It's commonly stated that the launch market will become slightly elastic below around $2m/tonne and will become moderately elastic below $1m/tonne (see, for example, the 1994 Commercial Space Transportation Study produced for NASA by Boeing). Below that level, space tourism and freefall processing of materials will become more common. If the price fell that far, we might expect to see these new applications appearing after a lag of five to ten years to allow the initial research and development of new spacecraft to occur. However, even at these price levels, launcher companies will only see a moderate increase in revenues. It's only at prices of around $100,000/tonne that the market will become highly elastic and revenues will sharply increase.

As noted above, even in the absence of elasticity of demand, a close examination of Figure 1 reveals that the price of commercial launches has been falling for about the last two decades. The reason for this is not hard to understand. Even though the size of the market is roughly stable, there are several competing companies providing launch services, and one determining factor behind the choice of launch vehicle by customers is price (there are others, of course, such as long-term relationships, reliability, relative accessibility of different orbits, and accuracy of orbital insertions). The quest for market share will slowly drive down the price of launches as each company chooses to invest in making its rockets cheaper. However, current launch vehicles are not reusable and the throwing away of the hardware with each launch leads to a floor on the cheapness of launches (imagine how expensive airline flights would be if planes were scrapped on every landing!). It seems likely that we're now approaching this floor and so companies will begin to compete on other factors, such as reliability. For the step by step evolution of the current launcher families to lead to much lower prices that take us into the elastic region would require a radical change in our entire manufacturing base (perhaps, for example, the invention of Drexlerian molecular nanotechnology). In the absence of such advances, we will be trapped in the current market conditions unless we develop reusable launchers.

There is a school of thought that says that if governments got out of the launch vehicle market then we would already have all the wonders whose absence is the subject of this series. Unfortunately, things are not as simple as that, for businesses alone are highly unlikely to open up the space frontier. The problem is that the development of reusable launch vehicles (RLVs) is extremely difficult and expensive. Furthermore, a second generation RLV (the Shuttle is a first generation RLV) is highly unlikely to take us further than the borderlands of the elastic regime. Suppose that a company which develops an RLV wins the whole market. Then it will have, say, all the launches for ten years to recoup the cost of the vehicle's development. Suppose, further, that the research and development effort costs $20 billion (a reasonable estimate given the cumulative development costs of the Ariane series and other major aerospace projects). Then the amortised development costs would be around $20-40 million per launch. In other words, the amortised cost of development may well wipe out any possible savings. Given that the history of reusable spacecraft projects is littered with expensive failures, and it's not surprising that aerospace companies are not exactly falling over themselves to develop RLVs with their own money.

As for governments, NASA has announced plans for a second generation RLV by 2010. This will probably not be a single-stage-to-orbit and is intended to reduce launch prices to around $2m/tonne (after the US government have financed the development). (This project may have now been merged with the Orbital Space Plane, which will offer no savings in launch costs at all.) A third generation vehicle, perhaps a single-stage-to-orbit design, is due to follow in 2025. This third generation RLV will supposedly reduce launch prices to $100,000/tonne and will allow airliner-like access to low orbit. Given the history of NASA's RLV projects, however, I think it's unlikely that these time and cost targets will be met - after all, the Shuttle was supposed to have been so cheap it would replace all other launch vehicles, and modern proposals for next generation launchers look uncannily like the proposals for the Shuttle in the 1970s.

Given all of this, it seems highly unlikely that we will have cheap access to space until the 2030s (if then). Our science-fictional dreams, which once felt so close, seem to be dissolving like mirages. Fortunately, however, this is not the case. In the next part of the series, I will explain how new insights will allow us to build all those wondrous things with the near future's expensive launch prices.

|

|

Thank you, Donna. That's pretty much the same reaction as I had when I first saw Orion's Arm! |

|

Nice looking (if utterly baffling!) image. To fully master your shih you should make the launcher captions easier to read by turning off or toning down the drop shadows (especially on Ariane). Incidentally it's a bit inaccurate to say that the SVG plug-in is needed "for older browsers" when I've just had to download it for Safari - which is one of the newest :) |

|

Very nice article. Too bad I didn't have the time to read it until now. I look forward to your next chapter. |

|

The price is actually running at the lowest it has been for 30 years- that's competition in action- noteably the Proton launcher is currently the cheapest; the Russians just price it to what the market will bear- it actually costs about $6 million to make, and launches 20 tonnes. Costs actually seem to be halving about every 5 years at present- it seems that this is likely to continue for the foreseeable future. For example, SpaceX is currently quoting a launch price of $1000/kg; and are hoping to launch this year. |

|

What's the next part in the series? You ended with, "In the next part of the series, I will explain how new insights will allow us to build all those wondrous things with the near future's expensive launch prices." I can't find it. Can you please point me in the right direction? Jack |

|

thanks a lot,, this article really helped me in my research on Space transportation cost and trends!! thanks whom can i refer as the author plz lemme knw! |

All I can say, is Wow! Donna